mass tax connect make estimated payment

You must make estimated payments if the expected tax due on your taxable income not subject to withholding is more. Please Enter 2022 MA Withholding Amount.

H R Block 2022 Tax Year 2021 Review Pcmag

Its fast easy and secure.

. The first step in making estimated tax payments is to calculate what you owe. Mass tax connect make estimated payment. Mail to Massachusetts Department of Revenue PO Box 419272 Boston MA 02241-9272.

How To Pay Estimated Taxes. Final Results _____ Total Estimated Tax For This Year. If you want to learn more about estimated tax payments in.

For some workers tax season doesnt end on April 19. Make your estimated tax payment online. This video tutorial shows you how to make an advance payment on MassTaxConnectSubscribe to DOR on Social.

Please Enter 2021 Overpayment Amount. Make your estimated tax payments online at massgovmasstax-connect and get immediate confirmation. The Massachusetts Department of Revenue DOR replaced their existing e-filing system WebFile.

Welcome to MassTaxConnect the Massachusetts Department of Revenues web-based application for filing and paying taxes in the Commonwealth. Tax Department Call DOR Contact Tax Department at 617 887-6367. The reason why it is an estimated tax payment is because you do not know exactly what your tax.

ONLINE MASS DOR TAX PAYMENT PROCESS STEP 1. This video tutorial shows you how to make an estimated payment in MassTaxConnectSubscribe to DOR on Social. Read on for a step by step guide on making tax payments in MA.

Income and Fiduciary estimated tax payments. Download or print the 2021 Massachusetts Form 1-ES Estimated Income Tax Payment Vouchers for FREE from the Massachusetts Department of Revenue. Use this link to log into Mass Depa.

Select Payment Type choose Return Payment for year 2019 if paying the balance. Business and fiduciary taxpayers must log in to make estimated extension or return. You may send estimated tax payments with Form 1040-ES by mail or you can pay online by phone or from your mobile device using the IRS2Go app.

Business taxpayers can make bill payments on MassTaxConnect without logging in. Individuals and fiduciaries can make estimated tax payments with MassTaxConnect. Select individual for making personal income tax payments or quarterly.

Your Tax Amount is Less Than 400.

Student Loan Forgiveness Programs For Relief Mass Forgiveness Student Loan Hero

How To Make Ma Dor Income Tax Payments Online The Onaway

Massachusetts Sales Tax Small Business Guide Truic

Millions Of Mass Taxpayers Will Get Money Back Starting In November Officials Say Here Are The Details The Boston Globe

Mass Taxpayers Will Get Billions Back Under Obscure 1980s Law Baker Says

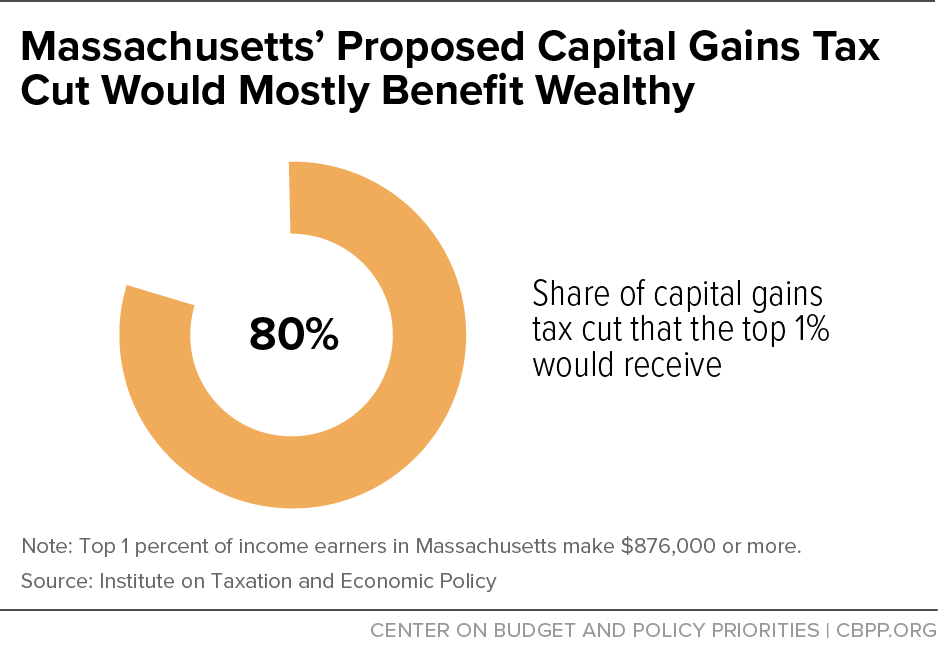

Massachusetts Should Focus On Building An Equitable Recovery Not Tax Cuts For The Wealthy Center On Budget And Policy Priorities

Estimated Tax Payment Quarterly Tax Payments Self Employment Tax

Strategies For Minimizing Estimated Tax Payments

Stimulus Checks And Tax Rebates Available In 17 States Money

Massachusetts Inheritance Laws What You Should Know Smartasset

Baker Tax Refunds To Start In November

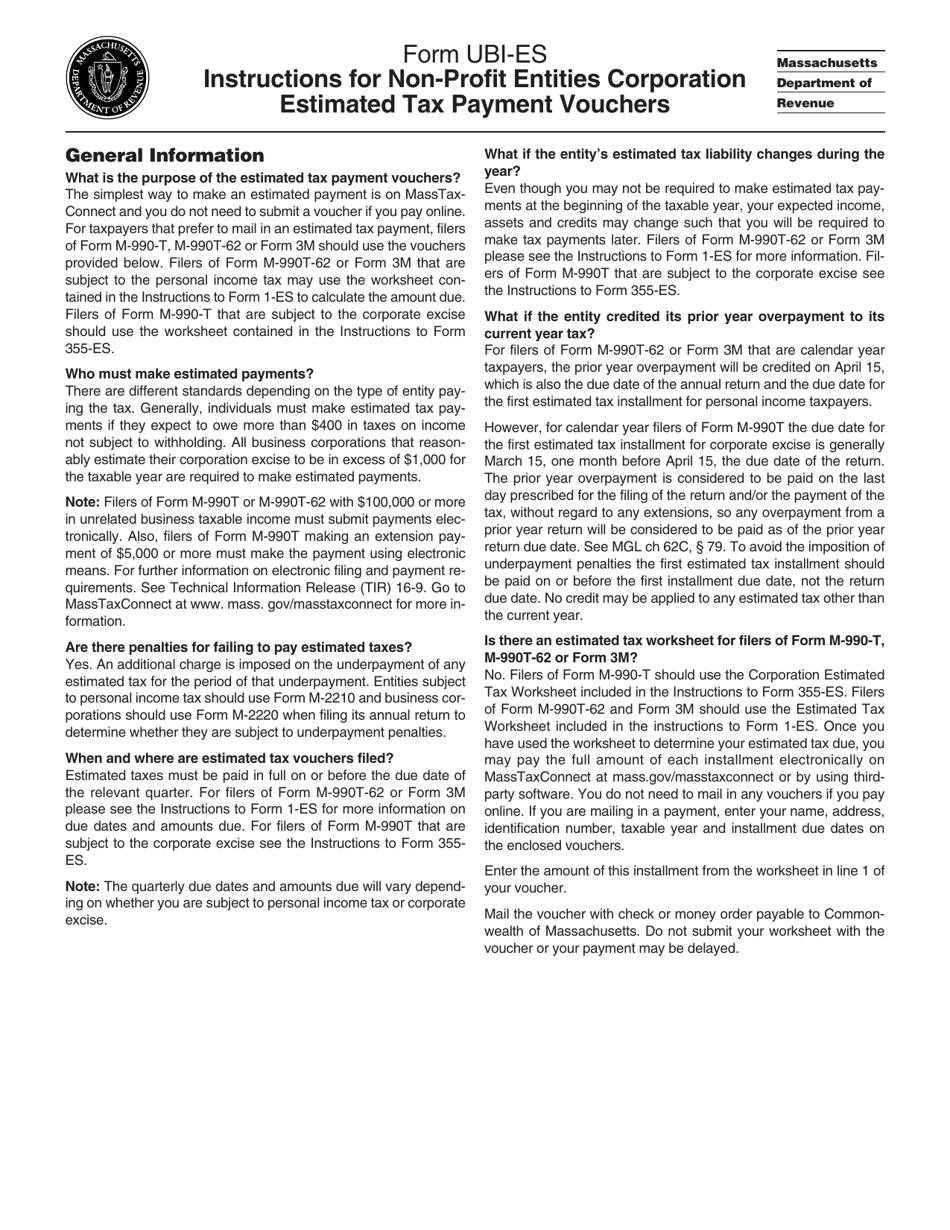

Form Ubi Es Download Printable Pdf Or Fill Online Non Profit Entities Corporation Estimated Tax Payment Vouchers 2022 Massachusetts Templateroller

Massachusetts Income Tax Rate Will Drop To 5 On Jan 1 Masslive Com

Massachusetts Dept Of Revenue Massrevenue Twitter

Mass Taxpayers To Get 3 Billion Back Under Obscure Law State Officials Say The Boston Globe