san francisco gross receipts tax ordinance

For businesses in the financial services industry the tax once fully phased in is expected to be imposed at rates between 040 for gross receipts up to 1 million and. 0465 eg 465 per 1000 for taxable gross receipts over 25000000.

Gross Receipts Tax And Other Indirect Pmba

Overpaid Executive Gross Receipts Tax Approved in San Francisco.

. On June 5 2018 San Francisco voters passed Proposition C which imposes a new gross receipts tax of 1 percent on revenues a business receives from leasing warehouse space in. Prop E means more jobs for San Franciscans. A Gross receipts means the total amounts received or accrued by a person from whatever source derived including but not limited to amounts.

The new tax takes effect on January 1 2022 and will be imposed on businesses in which the highest-paid executives. San Francisco Business and Tax Regulations Code. As noted in section 40116b of title 49 of the United States Code Section 40016b the Gross Receipts Tax in Article 12-A-1 of the San Francisco Business and Tax Regulations Code shall not apply to the gross receipts from that air commerce or transportation as that.

Prior to the election maximum business tax rates on gross receipts in San Francisco ranged from 016 percent to 065 percent. The voters of San Francisco the City recently approved Proposition E a gross receipts tax that will be phased in over five years beginning in 2014. By replacing San Franciscos payroll tax the impartial City Controllers analysis says Prop E will create thousands of new.

In addition to the existing Gross Receipts and Payroll Expense Taxes this measure imposes a new gross receipts tax of. The Overpaid Executive Tax also referred to as the Overpaid Executive Gross Receipts Tax was approved by San Francisco voters on November 3 2020 and became effective on. Gross Receipts Tax Applicable to Manufacturing.

In November 2012 San Francisco voters passed Proposition E The Gross Receipts Tax and Business Registration Fees Ordinance the Gross Receipts Tax. IMPOSITION OF GROSS RECEIPTS TAX. 1 on the amounts a business receives from the lease or.

On June 5 2018 San Francisco voters passed Proposition C which imposes a new gross receipts tax of 1 percent on revenues a business receives from leasing warehouse. In its first year 2014 the Gross Receipts Tax is imposed at 10 percent of the rates approved by the voters while the Payroll Expense Tax remains at 90 percent of the rate. Proposition C was designed to increase.

IMPOSITION OF GROSS RECEIPTS TAX. 1 This gross receipts tax will. 0868 eg 868 per 1000 for taxable gross receipts over 25000000.

3 For the business activities of financial services and professional scientific and technical services. 0465 eg 465 per 1000 for taxable gross receipts between 500000001 and 25000000. Homelessness Gross Receipts Tax HGR The Homelessness Gross Receipts Tax effective January 1 2019 imposes an additional gross receipts tax of 0175 to 069 on combined.

San Francisco Adopts Major Changes To Business Taxes 2019 Articles Resources Cla Cliftonlarsonallen

Business And Tax Regulations Code

Sales And Gross Receipts Taxes As Percentage Of Income Source U S Download Scientific Diagram

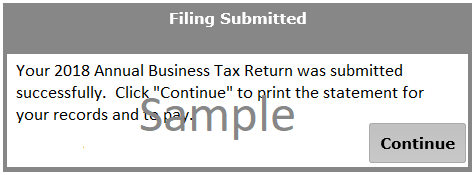

Annual Business Tax Return Instructions 2018 Treasurer Tax Collector

San Francisco Voters Approve Ballot Measures Overhauling City S Business Taxes And Imposing A New Overpaid Executive Gross Receipts Tax Deloitte Us

Doordash 1099 Taxes And Write Offs Stride Blog

San Francisco Begins Transition To Gross Receipts Tax The Bar Association Of San Francisco

San Francisco Begins Transition To Gross Receipts Tax The Bar Association Of San Francisco

A New Dimension For Llcs In California

California High Court Lets San Francisco S Disputed Homeless Tax Stand Courthouse News Service

A New Dimension For Llcs In California

San Francisco Voters Approve Ballot Measures Overhauling City S Business Taxes And Imposing A New Overpaid Executive Gross Receipts Tax Deloitte Us

Overpaid Executive Gross Receipts Tax Approved Jones Day

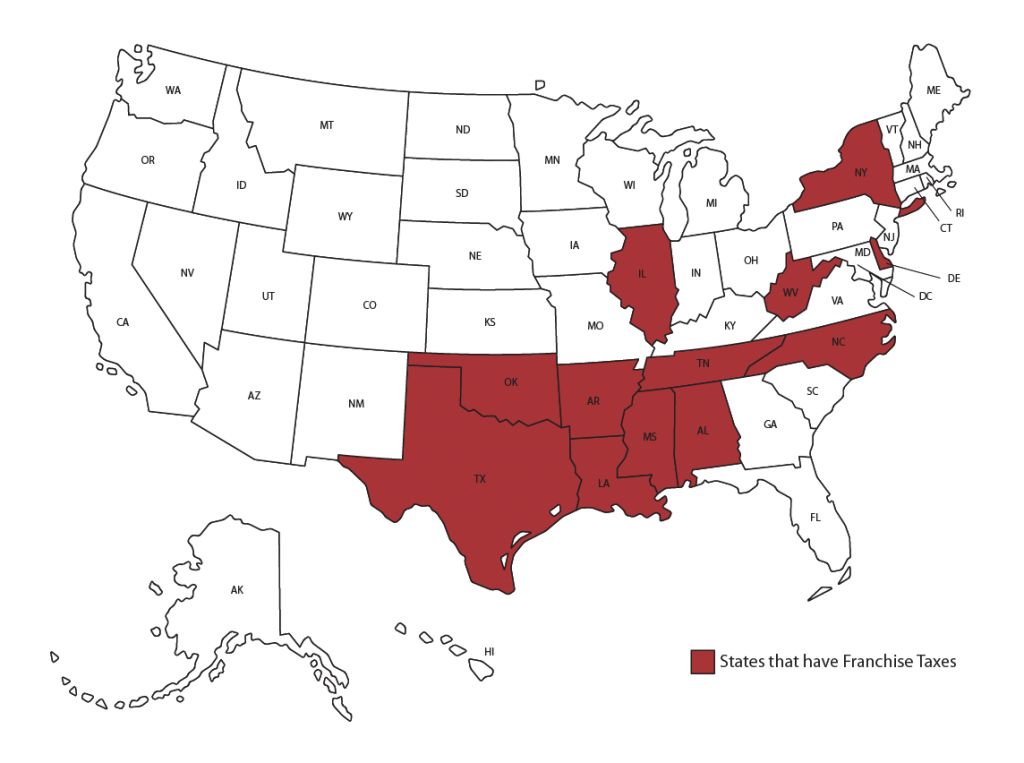

Nevada Voters To Consider Economically Damaging Gross Receipts Style Tax A Type Only Five Other States Have Tax Foundation

2023 San Francisco Tax Deadlines

Working From Home Can Save On Gross Receipts Taxes Grt Topia

San Francisco Begins Transition To Gross Receipts Tax The Bar Association Of San Francisco

San Francisco Prop F Business Tax Changes Spur

Ca San Francisco Proposition C Increases Gross Receipts Tax On Lessors Of Commercial Real Estate